Strategic asset allocation is one of the most essential aspects of a successful long-term investment strategy. Investing is an important component of building wealth. It will involve choosing and balancing a portfolio mix with great care to match your risk tolerance, time horizon, and financial objectives. You may manage risk and maximize returns by properly allocating your assets and making sure that your investments are working toward your goals.

We will discuss the idea of strategic asset allocation in this blog, emphasizing the significance of diversification for reducing risk, looking at the various kinds of investments that are available in India, and discussing best practices for creating a solid long-term investment plan. Knowing these ideas is crucial to building a diversified and successful investment portfolio, regardless of experience level.

What is Strategic Asset Allocation?

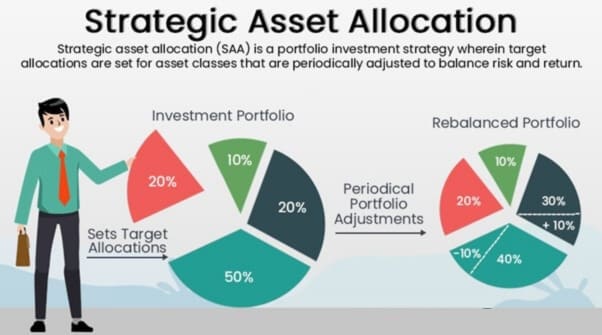

Strategic asset allocation is an investment strategy that involves creating a long-term plan for allocating investment capital across different asset classes. The objective is to achieve a balanced and diversified portfolio that aligns with the investor’s financial goals and risk tolerance. It is a disciplined approach that aims to optimize risk-adjusted returns over an extended period.

In strategic asset allocation, the investor selects a mix of asset classes, such as stocks, bonds, real estate, commodities, and cash, based on their historical performance, risk characteristics, and correlation with each other. These asset classes have different levels of risk and return potential. By diversifying investments across various asset classes, the investor aims to spread risk and potentially enhance returns by taking advantage of the differing performance cycles of each asset class.

The process involves determining target allocations for each asset class based on factors such as the investor’s investment objectives, time horizon, and risk appetite. These target allocations serve as a roadmap for portfolio construction and provide a framework for decision-making. Periodic rebalancing is also an integral part of strategic asset allocation, which involves adjusting the portfolio back to the target allocations over time to maintain the desired risk profile.

Importance of Diversification in Strategic Asset Allocation

One of the most important aspects of strategic asset allocation is diversification. Diversification involves spreading your investments across multiple asset classes, such as stocks, bonds, cash, and alternative investments, to reduce the impact of any one investment’s performance on your overall portfolio.

Diversification is particularly important, given the volatility of the Indian stock market. India is a developing country with a rapidly growing economy, but the stock market can be subject to significant fluctuations due to a variety of factors, including political instability, inflation, and currency devaluation.

To mitigate this risk, investors should consider investing in a diverse range of asset classes. For example, investors may choose to allocate a portion of their portfolio to stocks, bonds, and alternative investments such as real estate, commodities, or hedge funds.

Investment Options Available in India

India offers a wide range of investment options for investors, including stocks, bonds, mutual funds, and alternative investments. Below are some of the most popular investment options available in India:

- Stocks: Investing in stocks is one of the most popular investment options in India. The Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) are the two major stock exchanges in India, where investors can buy and sell stocks of Indian companies.

- Bonds: Bonds are a type of fixed-income investment that offers a regular income stream. The Indian government and companies issue bonds, and investors can buy them through banks or brokers.

- Mutual Funds: Mutual funds are a type of investment vehicle that pools money from multiple investors and invests in a diversified portfolio of stocks, bonds, or other assets. There are many different types of mutual funds available in India, including equity funds, debt funds, and hybrid funds.

- Real Estate: Real estate is a popular alternative investment option in India, with many investors choosing to invest in rental properties or commercial real estate.

Best Practices for Building a Long-Term Investment Strategy

When building a long-term investment strategy, investors should consider the following best practices:

- Define Your Investment Goals: Before building an investment strategy, investors should define their investment goals. This may include factors such as retirement planning, education planning for children, or saving for a down payment on a home.

- Assess Your Risk Tolerance: Understanding your risk tolerance is crucial when building an investment strategy. Investors with a high risk tolerance may choose to allocate a larger portion of their portfolio to stocks, while those with a lower risk tolerance may prefer to invest more in bonds or other fixed-income investments.

- Determine Your Asset Allocation: Once you have defined your investment goals and assessed your risk tolerance, it’s time to determine your asset allocation. This involves deciding how much of your portfolio you will allocate to different asset classes, such as stocks, bonds, and alternative investments.

- Rebalance Your Portfolio Regularly: As market conditions change, it’s essential to rebalance your portfolio regularly. This involves adjusting your asset allocation to ensure that it remains aligned with your investment goals and risk tolerance.

- Invest in High-Quality Assets: When investing in India, it’s important to choose high-quality assets. This may include stocks of companies with a strong track record of performance, high-quality bonds, or mutual funds managed by reputable asset managers.

Execution

Once the asset allocation strategy is formulated, it is important to implement it in a disciplined manner. The implementation involves selecting the specific investments that will make up the portfolio. The selection of investments should be done carefully and should be based on the risk and return objectives of the investor.

There are various investment options available for investors to implement their asset allocation strategies. Some of the popular investment options include stocks, bonds, mutual funds, and real estate. Each of these investment options has its own set of advantages and disadvantages, and investors need to carefully evaluate them before making any investment decisions.

For example, stocks offer the potential for high returns but come with a high degree of risk. Bonds, on the other hand, offer a lower return but are less risky. Mutual funds offer diversification and professional management, but come with fees and expenses. Real estate offers the potential for high returns, but can be illiquid and require a large capital investment.

Investors also need to consider the tax implications of their investments. In India, the tax laws are complex and change frequently. Investors need to be aware of the tax implications of their investments and plan accordingly.

Also, read Does Coffee Can Investing Work in 2023?

Monitoring and Rebalancing the Portfolio

Once the portfolio is implemented, it is important to monitor and rebalance it regularly. The performance of the portfolio needs to be tracked regularly to ensure that it is on track to meet the investor’s long-term objectives. If the portfolio is not performing as expected, adjustments need to be made.

Rebalancing the portfolio involves adjusting the allocation of assets to maintain the desired asset allocation. Over time, the performance of different asset classes can vary, leading to a change in the portfolio’s asset allocation. Rebalancing ensures that the portfolio remains aligned with the investor’s long-term objectives.

Also, read How Trying to Look Rich Is Keeping You Poor

Conclusion

Strategic asset allocation is an important investment strategy for long-term investors. It involves creating a diversified portfolio that is aligned with the investor’s risk and return objectives. The process of creating a strategic asset allocation involves determining the investor’s risk tolerance, identifying the appropriate asset classes, selecting specific investments, and monitoring and rebalancing the portfolio regularly.

There are various investment options available for investors to implement their asset allocation strategies. Investors need to carefully evaluate the various investment options and consider the tax implications of their investments.

Implementing a strategic asset allocation strategy requires discipline and a long-term perspective. It is important to stick to the plan, even during times of market volatility. With careful planning and implementation, a strategic asset allocation strategy can help investors achieve their long-term investment objectives.

Frequently Asked Questions-

What is the role of Strategic Asset Allocation?

The role of strategic asset allocation is to optimize portfolio performance by strategically allocating investments across different asset classes, balancing risk and return to achieve long-term financial goals.

What are the 3 approaches to Asset Allocation?

The three approaches to asset allocation are:

- Strategic Asset Allocation: Setting long-term target allocations based on goals and risk tolerance.

- Tactical Asset Allocation: Making short-term adjustments based on market conditions.

- Dynamic Asset Allocation: Using predefined rules or models to adjust allocations based on market indicators and performance.

Difference between Strategic and Tactical Asset Allocation?

Strategic asset allocation is a long-term plan with target allocations, while tactical asset allocation involves shorter-term adjustments based on market conditions.