Credit card balance transfer is a financial strategy that can help individuals in managing their credit card debts effectively. It refers to the process of transferring outstanding credit card balances from one card to another with a lower interest rate, thus enabling the debtor to save money on interest payments.

Credit card balance transfers have gained significant popularity over the years, primarily due to the high-interest rates charged by credit card companies. According to a report by the Reserve Bank of India, the average interest rate charged by credit card companies in India is around 36%, which is significantly higher than other forms of credit such as personal loans.

As a result, individuals who are struggling with high credit card debts often find it difficult to manage their finances effectively. Credit card balance transfer can be a useful tool for such individuals to reduce their interest payments and manage their debts effectively.

What is a Credit Card Balance Transfer?

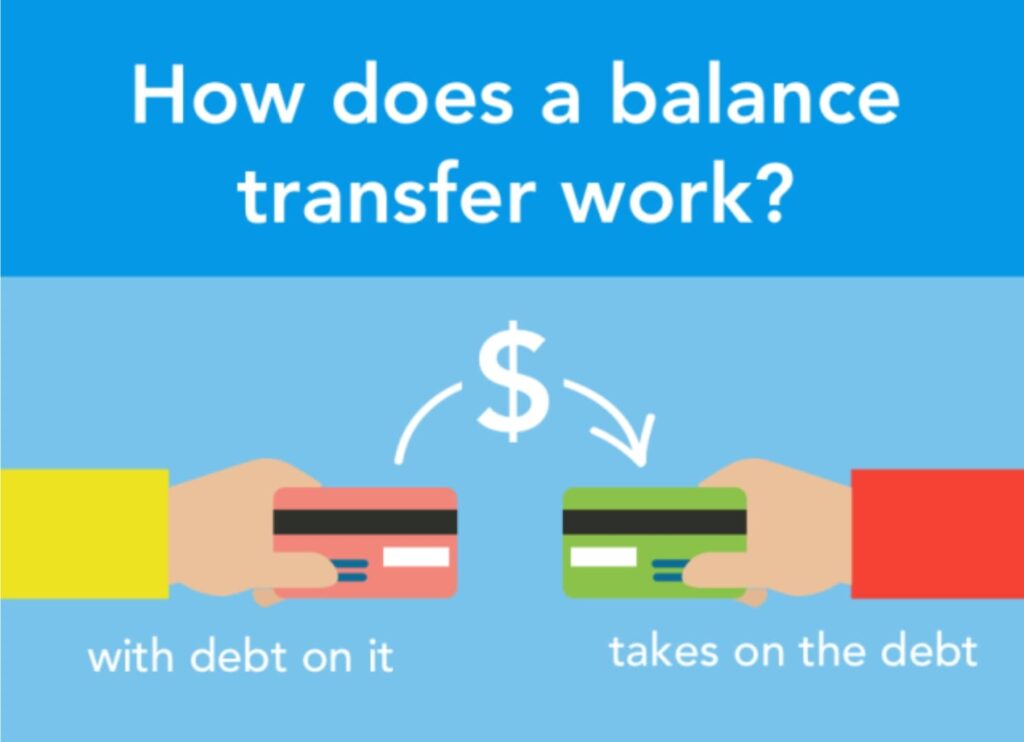

A credit card balance transfer involves moving the outstanding balance from one credit card to another. This is typically done to take advantage of lower interest rates or promotional offers available with the new credit card. The process starts with researching and comparing different credit card issuers to find the most favorable terms. Once a suitable card is identified, an application is made, and if approved, the balance transfer is initiated by providing the necessary information about the existing card and the amount to be transferred. The new card issuer pays off the old card’s balance, and going forward, the debt is owed to the new credit card issuer.

Credit card balance transfers offer potential benefits such as interest savings and debt consolidation. However, it is important to carefully review the terms and conditions of the new card, including any fees associated with the transfer, the interest rates after any promotional period, and any other applicable costs. Timely repayments are crucial to avoid penalties or negative impacts on credit scores. Conducting thorough research and understanding the terms will help make an informed decision and maximize the benefits of a credit card balance transfer.

How does a Credit Card Balance Transfer work?

credit card balance transfer is a process that allows you to move an existing credit card debt from one credit card to another. Here’s how it generally works:

- Find a new credit card: Look for credit card offers that provide balance transfer options. Compare the terms and conditions, including the promotional interest rate, transfer fees, and any other relevant factors.

- Apply for the new credit card: Once you’ve selected a credit card that suits your needs, apply for it and go through the approval process. Make sure you meet the eligibility criteria and provide the necessary information.

- Specify the balance transfer amount: After you’re approved for the new credit card, you’ll typically need to specify the amount you want to transfer from your existing credit card. This can usually be done during the application process or later on through your new credit card’s online account management system.

- Transfer the balance: Once your new credit card account is set up, the credit card issuer will initiate the balance transfer process. They will contact your old credit card issuer and arrange to pay off the outstanding balance on your behalf.

- Wait for the transfer to complete: The balance transfer process can take some time, usually ranging from a few days to a few weeks. It’s important to continue making payments on your old credit card until the transfer is confirmed.

- Start making payments on the new credit card: Once the balance transfer is complete, you’ll start making payments on the new credit card. The transferred balance will appear on your new credit card statement, and you’ll be responsible for paying it off based on the terms of the new card.

How to do a Credit Card Balance Transfer?

Credit card balance transfer works in a simple manner An individual can transfer the outstanding balance from one credit card to another with a lower interest rate. The process involves the following steps:

Step 1: Choose a credit card with a lower interest rate

The first step in the credit card balance transfer process is to identify a credit card with a lower interest rate. In India, several credit card companies offer balance transfer facilities with lower interest rates to attract customers.

Individuals should carefully compare the interest rates and other fees charged by different credit card companies to choose the one that suits their needs and budget.

Step 2: Apply for a balance transfer

Once an individual has identified the credit card company with a lower interest rate, they can apply for a balance transfer. The application process typically involves filling out a form with details of the outstanding balance and the credit card account from which the balance needs to be transferred.

The credit card company offering the balance transfer facility will then verify the details and approve the transfer. The approval process may take a few days to a week, depending on the credit card company’s policies.

Step 3: Repay the transferred balance

After the balance transfer is approved, the outstanding balance is transferred to the new credit card account. The individual will then have to repay the transferred balance to the new credit card company within the specified time frame.

It is important to note that credit card companies offering balance transfer facilities often have specific terms and conditions related to the repayment of the transferred balance. Individuals should carefully read and understand these terms and conditions to avoid any penalties or additional fees.

Also, read How to Increase Cibil Score from 600 to 750?

Advantages of Credit Card Balance Transfer

Credit card balance transfer can offer several advantages to individuals who are struggling with high credit card debts. Some of the key advantages are:

- Lower Interest Rates: One of the primary advantages of credit card balance transfer is the lower interest rates charged by credit card companies. By transferring their outstanding balances to a credit card with a lower interest rate, individuals can significantly reduce their interest payments and save money.

- Consolidation of Debts: Credit card balance transfer can also help individuals in consolidating their debts. Instead of having multiple credit card accounts with outstanding balances, individuals can transfer all their balances to a single credit card account, making it easier to manage their debts effectively.

- Flexible Repayment Options: Many credit card companies offering balance transfer facilities also provide flexible repayment options to individuals. This can include lower minimum payments or longer repayment tenures, making it easier for individuals to manage their debts effectively.

- Improved Credit Score: By effectively managing their credit card debts through balance transfer, individuals can also improve their credit score over time. A higher credit score can help individuals in accessing better credit options in the future.

Examples of Credit Card Balance Transfer

Several credit card companies in India offer balance transfer facilities to their customers. Let us take a look at some of the popular examples of credit card balance transfer are: