One of the most important first steps toward obtaining financial stability and long-term objectives is to save money from your salary. By using effective saving techniques, you can enhance your earnings and lay a solid financial foundation for your future. This blog post will explore seven tried-and-true methods for saving money from your pay, along with helpful suggestions to help you increase your savings and improve the way you handle your money. We’ll talk about the important subject of how much of your pay you should set aside each month in order to reach your financial goals.

These insights will give you the resources you need to start along the road to financial success, whether your goals are to save for a big purchase, accumulate an emergency fund, or just make better financial habits. Let’s look at some ways to optimize your savings and make the most out of your pay.

How much salary should you save every month?

Determining the exact amount of salary you should save every month depends on various factors, including your financial goals, current expenses, and individual circumstances. As a general guideline, financial experts often recommend saving at least 20% of your monthly income. However, this percentage may vary depending on your specific goals and financial situation. It’s important to strike a balance between saving for the future and meeting your present needs. Assess your financial priorities, consider your expenses, and set a realistic savings target that aligns with your objectives.

Also, read Ignite Your Wealth: How to Invest in REIT in India in 2023

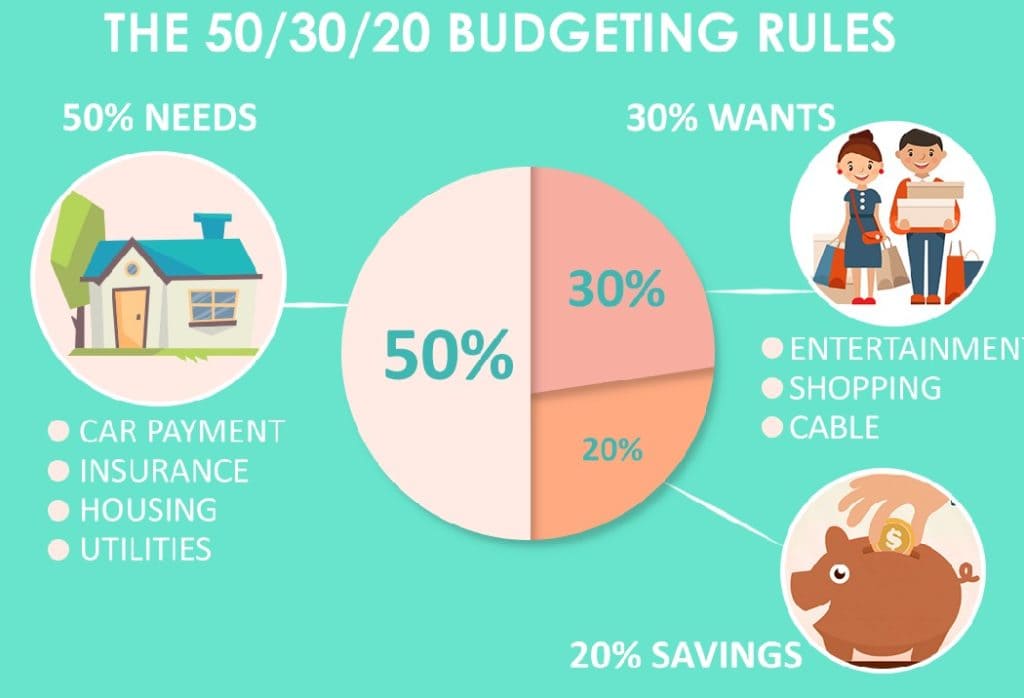

What is the 50-30-20 rule?

The 50/30/20 rule is a popular guideline for personal budgeting. It suggests dividing your after-tax income into three categories:

- 50% for Needs: Allocate 50% of your income towards essential expenses and necessities, such as housing, utilities, groceries, transportation, and healthcare. These are the expenses that you must pay to maintain a basic standard of living.

- 30% for Wants: Dedicate 30% of your income towards discretionary expenses and wants, such as dining out, entertainment, travel, hobbies, and non-essential shopping. These are expenses that enhance your lifestyle and bring you joy, but they are not essential for day-to-day living.

- 20% for Savings and Debt Repayment: Reserve 20% of your income for savings, investments, and debt repayment. This includes building an emergency fund, contributing to retirement accounts, saving for future goals, and paying off debts faster.

The 50/30/20 rule provides a simple framework to ensure that you allocate your income in a balanced way, covering both your needs and wants while also prioritizing savings and debt management. However, it is important to adapt this rule to your individual circumstances and adjust the percentages based on your financial goals and priorities.

Also, read How to Find Multibagger Stocks in 2023: Uncovering Hidden Gems.

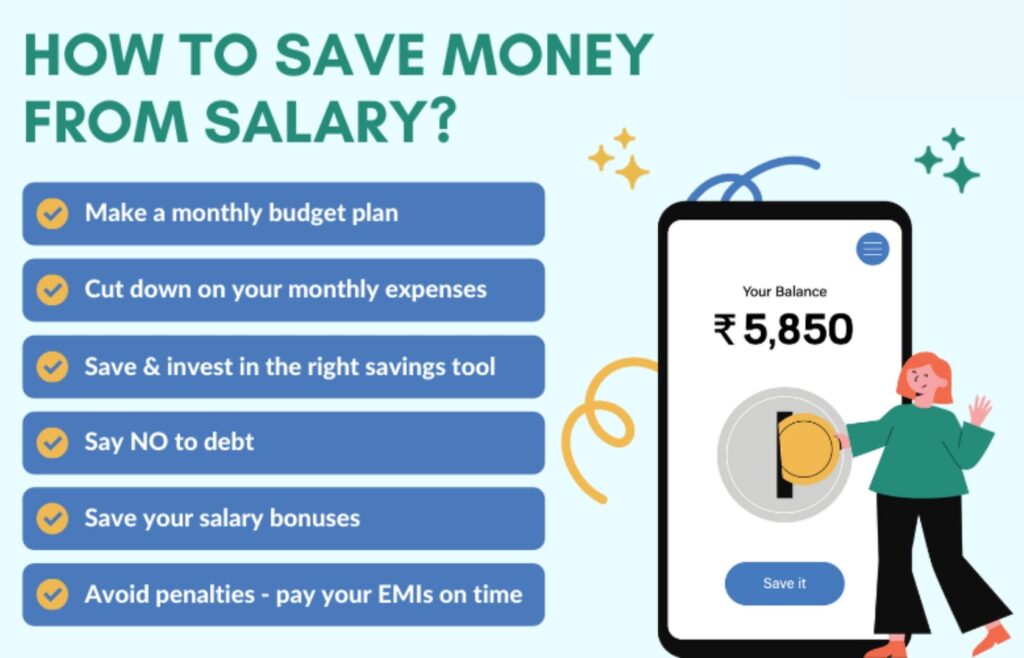

7 Smart Ways to Save Money from Your Salary

- Create a Budget and Track Your Expenses: Start by creating a comprehensive budget that outlines your monthly income and expenses. Categorize your expenses, including essentials like rent, utilities, and groceries, as well as discretionary spending. Tracking your expenses will give you a clear picture of where your money is going and help identify areas where you can cut back.

- Automate Your Savings: Set up automatic transfers from your salary account to a separate savings account each month. This “pay yourself first” approach ensures that a portion of your income goes directly into savings before you have a chance to spend it. This simple yet powerful technique helps you build savings effortlessly.

- Reduce Unnecessary Expenses:

Reduce Unnecessary Expenses Take a critical look at your spending habits and identify areas where you can cut back. Analyze discretionary expenses such as dining out, entertainment, and subscriptions. Consider finding more affordable alternatives or reducing the frequency of these expenses to free up more money for savings.

- Set Realistic Financial Goals: Establish specific and achievable financial goals that align with your priorities. Whether it’s saving for an emergency fund, a down payment on a house, or a dream vacation, having clear goals provides motivation and a sense of purpose. Break down your goals into smaller milestones and track your progress regularly.

- Negotiate Bills and Expenses: Don’t be afraid to negotiate with service providers for better deals on your bills, such as internet, cable, or insurance. Research competitive rates and leverage that information to negotiate discounts or lower rates. Small savings on recurring expenses can add up significantly over time.

- Embrace Frugal Living: Practice frugal living by adopting money-saving habits in your daily life. Opt for homemade meals instead of eating out, use public transportation or carpool to save on commuting costs, and explore free or low-cost entertainment options like parks, libraries, and community events. Embracing frugality allows you to enjoy a fulfilling lifestyle while keeping expenses in check.

- Increase Your Income: Consider exploring opportunities to increase your income beyond your primary salary. This could involve taking up freelance work, starting a side business, or pursuing additional skills that can lead to higher-paying job prospects. Supplementing your salary with additional income sources can accelerate your savings growth.

Also, read How to Save Big with Credit Card Balance Transfer in 2023.

How Can You Budget Your Monthly Salary?

- Calculate Your Total Income: Determine your total monthly income, including your salary, any additional sources of income, or side hustle earnings. This will give you an accurate starting point for budgeting.

- Identify Fixed Expenses: Make a list of your fixed expenses, which are recurring costs that remain relatively stable each month. This includes rent or mortgage payments, utilities, insurance premiums, loan repayments, and any other fixed bills.

- Track Variable Expenses: Track your variable expenses, which are costs that can fluctuate from month to month. These may include groceries, transportation, dining out, entertainment, and discretionary spending. Review your past spending patterns or use budgeting apps to gain insights into your variable expenses.

- Set Financial Goals: Determine your short-term and long-term financial goals. This could include building an emergency fund, saving for a down payment, paying off debts, investing, or planning for retirement. Assign specific amounts and timeframes to each goal.

- Allocate Funds: Allocate your income based on your fixed expenses, variable expenses, and financial goals. Ensure that you prioritize essential expenses and allocate a portion towards savings and debt repayment.

- Track and Adjust: Monitor your budget regularly and track your actual expenses against your budgeted amounts. This will help you identify areas where you may be overspending and allow you to make necessary adjustments.

- Make Saving a Priority: Aim to save a portion of your income each month. Set up automatic transfers to a separate savings account to make saving more convenient and consistent. Start with a small percentage and gradually increase it as you get comfortable.

- Review and Revise: Review your budget periodically and make revisions as needed. Life circumstances and financial goals can change, so your budget should adapt accordingly.

By following these steps, you can effectively budget your monthly salary, gain control over your finances, and work towards achieving your financial goals. Remember, consistency and discipline are key to successful budgeting.

Also, read Credit Cards Against FD: Is It the Right Choice for You in 2023?

Conclusion

Saving money from your salary is not only about cutting back on expenses but also adopting a mindset of mindful spending and prioritizing your financial goals. By implementing these 7 smart strategies and determining an appropriate percentage to save each month, you can take control of your finances, boost your savings, and pave the way toward a more secure and prosperous future. Start implementing these tips today and enjoy the satisfaction of seeing your savings grow steadily over time.

Saving money from salary needs more than merely reducing expenses; it also requires prioritizing your financial objectives and developing a deliberate attitude toward your spending. You must put effective strategies into practice and choose an appropriate monthly savings percentage in order to save money from your salary. You can take charge of your money, greatly increase your savings, and create the foundation for a more stable and prosperous future by doing this.

Put these techniques into action right now, and you’ll experience the satisfying feeling of seeing your savings increase over time. By using these strategies on a regular basis, you’ll improve your financial situation and get closer to reaching your long-term financial goals.

FAQs

How should I diversify my investments?

To diversify your investments, allocate your money across different asset classes (stocks, bonds, real estate, etc.), geographic regions, sectors, and individual securities. This spreads the risk and reduces the impact of any single investment's performance on your overall portfolio.

How much should I save from my salary each month?

Aim to save at least 20% of your income each month, but adjust the amount based on your financial goals, income, and expenses. Start with a smaller percentage if needed and gradually increase it over time.

How much savings should I have at 25?

By the age of 25, it is generally recommended to have saved at least three to six months' worth of living expenses as an emergency fund.

Is there any way I can automate my investments?

Automate your investments by setting up SIP, by which a particular amount will automatically get invested at regular time intervals.