Who Are FIIs and Why Do They Matter?

Foreign Institutional Investors (FIIs) are big global players like mutual funds, pension funds, hedge funds, and investment firms that invest in markets outside their home countries. For them, India has always been attractive thanks to its fast-growing economy, huge consumer base, and vibrant stock market.

When FIIs buy, markets rise and confidence grows. But when they sell, money flows out, the rupee weakens, and markets turn volatile. Simply put, FIIs bring both opportunity and risk, and that’s why their moves are watched so closely.

Why Are FIIs Selling Indian Equities?

The recent wave of FII selling in Indian equities can be attributed to a combination of global and domestic factors. These forces have made India a less attractive investment destination in the short term, pushing FIIs to redirect their funds elsewhere. Here are the key reasons driving this trend-

1. Rising U.S. Treasury Yields

As U.S. Treasury yields climb, they provide a safer and more attractive alternative to equities in emerging markets like India. Higher yields mean that FIIs can earn better returns with significantly lower risk by parking their funds in U.S. bonds, making Indian markets less appealing.

U.S. government bonds have turned more attractive as Treasury yields keep rising. Yields are now at 4.54%, up from 3.6% in Sept 2024. This jump came after the U.S. Fed slowed down rate cuts under President Trump, pushing bond returns higher again. With such higher and safer returns, investors prefer U.S. bonds over riskier assets like Indian equities. This has led to capital outflows from India and stronger demand for the U.S. dollar.

2. Rupee Depreciation

The Indian rupee has experienced significant depreciation over the years, falling from around Rs. 60 against the U.S. dollar in 2015 to its current level of Rs. 86.3. This decline is largely driven by the strengthening of the U.S. dollar, as reflected in the upward trend of the U.S. Dollar Index.

The rupee has slipped from ₹83 in Sept 2024 to ₹86.3 in Jan 2025, mainly because FIIs have been pulling money out of Indian equities. They’re moving funds into U.S. government bonds, which offer higher and safer returns. A weaker rupee eats into the dollar returns of foreign investors, making Indian stocks less attractive. To protect their gains, many FIIs are choosing to exit their positions when the rupee trades at lower levels.

Impact of Rupee Depreciation on Dollar-Denominated Returns

Scenario: Rupee Depreciates from ₹80 to ₹85

Imagine an investor puts ₹10,00,000 into Indian equities when the exchange rate is ₹80 to 1 U.S. dollar. This means the initial investment is worth $12,500.

Now, the value of the investment increases by 20% in rupee terms, making it worth ₹12,00,000. However, because the rupee has depreciated to ₹85, the value of the investment in dollars is only $14,117.65.

So, the investor’s dollar gain is $1,617.65, which is a 12.94% gain in U.S. dollars as against a 20% gain in rupee terms.

3. Expensive Valuations

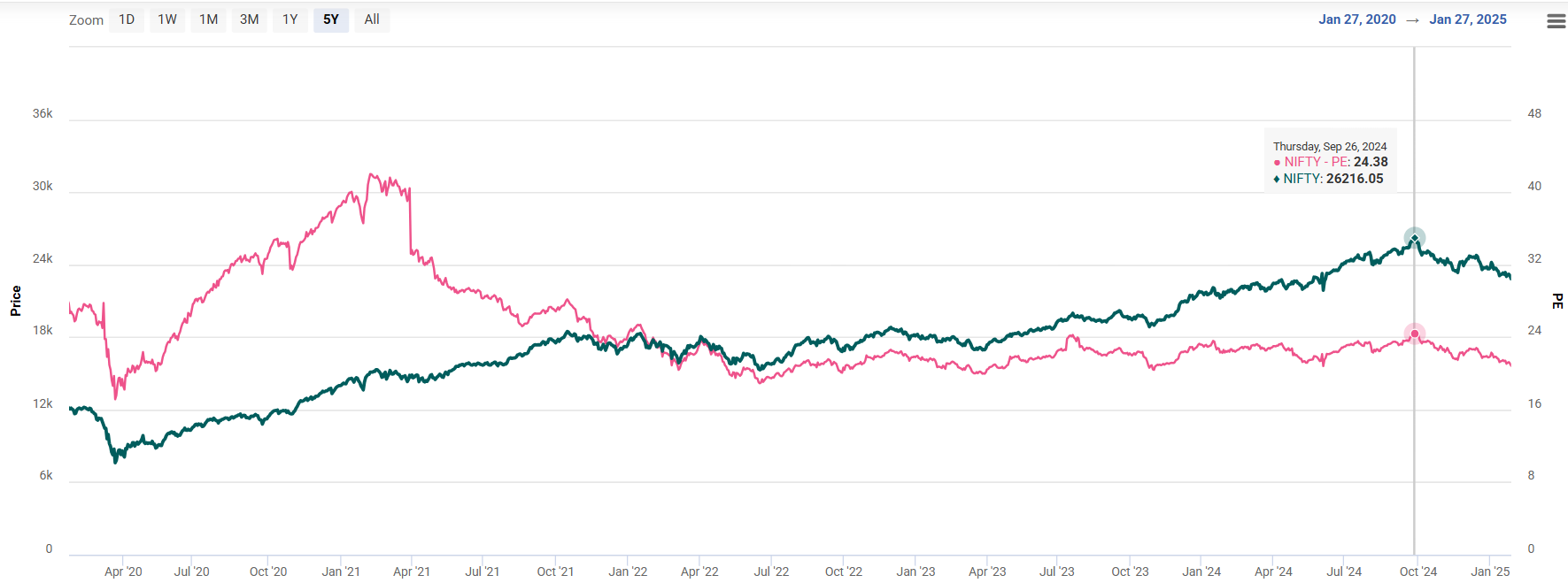

After the election results, the market bounced back sharply and kept rising through the Budget 2024. Even though capital gains taxes went up, confidence in the government and stable interest rates pushed stocks higher. From Sept 2023 to Sept 2024, the Nifty jumped over 30%, with even bigger gains in small and mid-caps.

But this rally made valuations expensive. The Nifty’s P/E crossed 24, making Indian stocks costlier than many global markets. While this shows belief in India’s growth story, it also makes FIIs cautious, as they now prefer cheaper opportunities elsewhere.

The market is falling because growth is slowing, company earnings are weak, and FIIs are selling. This is making investors less confident about the rally.

4. Global Economic Uncertainty

Geopolitical tensions, worries about a global slowdown, and stubborn inflation have made FIIs more cautious than before. Instead of taking big risks, they are moving money to markets that look safer and cheaper. One clear example is China, where stocks trade at a P/E of just 10, making it far more attractive compared to India’s higher valuations.

This shift means less foreign money flowing into India. Our markets have delivered strong returns, but that also makes them look expensive. FIIs now prefer places where they can buy more value for their dollar. Along with China, they’re also parking funds in bonds, gold, and developed markets.

FIIs are not giving up on India’s growth story, but in today’s uncertain world, they’re playing it safe and spreading their money where valuations look more comfortable.

Navigating the Current Market Landscape

The recent FII selling has pulled the market down, but corrections are normal and often healthy. Right now, rising U.S. yields, global uncertainty, and a weak rupee have made Indian stocks less attractive in the short term.

But the bigger picture is still positive. India’s economy is growing, digital transformation is picking up, and reforms are in place. As global rates cool down, FIIs are likely to return.

For investors, this phase is a chance to review portfolios and buy quality stocks at better prices. Staying disciplined with long-term plans like SIPs can help ride out the volatility. A correction isn’t a setback; it’s just part of the journey.