In India, the Credit Information Bureau Limited (CIBIL) is the most popular credit bureau that maintains credit records of individuals and organizations. A credit score, also known as the CIBIL score, is a numeric representation of an individual’s creditworthiness. The score ranges from 300 to 900, and a score above 750 is considered good. If you have a low CIBIL score, there are several steps you can take to improve it. This blog will discuss how to increase Cibil Score from 600 to 750. A good credit score is essential for individuals seeking credit facilities from financial institutions.

Understanding the Factors Affecting CIBIL Score

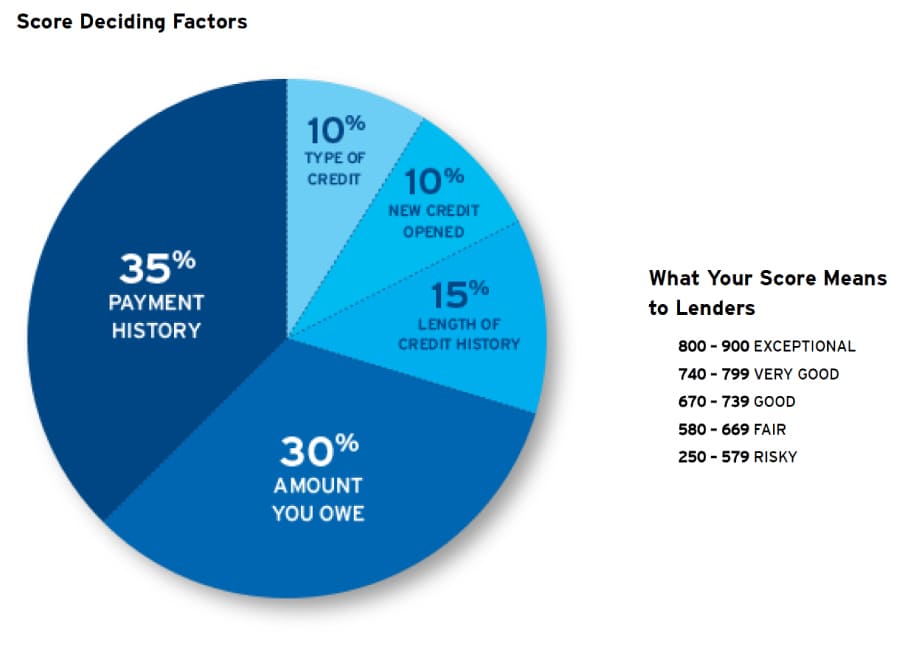

Before we discuss how to improve your CIBIL score, it is essential to understand the factors that affect your score. Your CIBIL score is calculated based on various factors, including your credit history, payment history, credit utilization, and credit mix. Let’s discuss these factors in detail.

- Credit history: This factor includes the length of your credit history, the number of credit accounts you have, and the type of credit accounts. The longer your credit history, the better your score. Having a mix of different types of credit accounts, such as credit cards and loans, can also improve your score.

- Payment history: This factor considers whether you have paid your credit bills on time or not. Late payments, defaults, and settlements can negatively impact your score.

- Credit utilization: This factor considers how much credit you are using compared to the credit available to you. It is recommended to use less than 30% of your available credit limit.

- Credit mix: This factor considers the types of credit accounts you have, such as secured and unsecured loans, credit cards, and others. Having a mix of credit accounts can improve your score.

Also, read Does Coffee Can Investing Work in 2023?

Some common reasons for low Cibil Score are:

- Late or Missed Payments

- High Credit Card Balances

- Too Many Credit Applications

- Defaulting on Loans or Bankruptcy

- Lack of Credit History

- Inaccurate Information on Credit Report

- High Debt-to-Income Ratio

It’s important to consider that these are general reasons, and individual circumstances may vary. Maintaining a good credit score requires responsible financial habits, such as paying bills on time, keeping credit card balances low, and managing debts effectively.

How much Cibil Score is good?

A good CIBIL score typically falls within the range of 700 to 900. The closer your score is to 900, the better it is considered. Lenders and financial institutions view a higher CIBIL score as an indication of responsible credit behavior and lower credit risk. With a good CIBIL score, you are more likely to be approved for credit applications and offered favorable interest rates and terms.

| Credit scores Range | Criteria |

|---|---|

| <580 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-900 | Exceptional |

It’s important to note that different lenders may have their own specific criteria and thresholds for determining creditworthiness, but generally, a CIBIL score above 700 is considered good.

Why Cibil Score is important?

CIBIL score, also known as a credit score, is important for several reasons:

- Loan Approvals: Financial institutions, such as banks and lenders, use your CIBIL score to assess your creditworthiness when you apply for loans or credit cards. A high CIBIL score increases your chances of getting approved for credit and obtaining favorable loan terms.

- Interest Rates: Your CIBIL score directly influences the interest rates offered to you. A higher score indicates lower credit risk, leading to more favorable interest rates. With a good CIBIL score, you can secure loans and credit cards at lower interest rates, saving you money on repayments.

- Credit Card Approvals: Credit card companies consider your CIBIL score to determine whether to approve your credit card application. A good score increases the likelihood of approval and may also result in higher credit limits and better rewards and benefits.

- Negotiating Power: A strong CIBIL score gives you negotiating power when dealing with lenders and financial institutions. It enables you to request lower interest rates, favorable loan terms, or higher credit limits based on your creditworthiness.

- Future Financial Planning: Maintaining a good CIBIL score is essential for long-term financial planning. It allows you to access credit when needed, secure better interest rates, and have more financial flexibility for major life events such as buying a home or starting a business.

CIBIL score is important because it impacts your loan approvals, interest rates, credit card applications, rental applications, employment prospects, negotiating power, and future financial planning. By maintaining a good CIBIL score, you can enjoy the benefits of favorable credit opportunities and financial stability.

How to Increase Cibil Score from 600 to 750?

Improving your CIBIL score from 600 to 750 requires a systematic approach and cannot be achieved immediately. It takes time and consistent effort to demonstrate responsible credit behavior and build a positive credit history. However, there are some steps you can take to work towards increasing your CIBIL score. Here are some steps/points on how to increase your score from 600 to 750-

- Check your credit report: The first step to improving your CIBIL score is to check your credit report. You can request a free credit report from CIBIL once a year. Your credit report will provide you with information about your credit history, credit accounts, payment history, and other factors that affect your score. Check your credit report for errors, such as incorrect personal information, wrong payment history, or any inaccuracies in the credit accounts. If you find any errors, dispute them with CIBIL to have them corrected.

- Pay your bills on time: Payment history is one of the critical factors that affect your CIBIL score. Late payments, defaults, and settlements can negatively impact your score. It is essential to pay your credit bills on time to avoid any negative impact on your score. Set up reminders or automatic payments to ensure that you pay your bills on time.

- Reduce your credit utilization: Credit utilization is another critical factor that affects your CIBIL score. It is recommended to use less than 30% of your available credit limit. If you are using more than 30% of your credit limit, it can negatively impact your score. You can reduce your credit utilization by paying off your credit card balance in full each month or requesting a credit limit increase from your credit card issuer.

- Maintain a good credit mix: Having a mix of different types of credit accounts can improve your CIBIL score. If you have only one type of credit account, such as a credit card, consider adding a different type of credit account, such as a personal loan or a car loan, to your credit portfolio.

How to Increase Cibil Score from 600 to 750? - Don’t apply for too much credit at once: Applying for multiple credit facilities at once can make you appear credit-hungry to lenders and negatively impact your score. Each application for credit leads to a hard inquiry on your credit report, which can lower your score. Instead, space out your credit applications and only apply for credit facilities that you genuinely need.

- Close unused credit accounts: Having too many open credit accounts can negatively impact your score, especially if you are not using them. It is recommended to close any unused credit accounts to improve your score. However, make sure you keep your oldest credit account open, as it contributes to your credit history.

- Negotiate settlements: If you have any outstanding debts or settlements, it is essential to negotiate with your creditors to settle the debt. Settling the debt can help improve your score, but make sure you get a settlement letter from your creditor stating that the account is closed and settled.

- Monitor your credit report regularly: Monitoring your credit report regularly can help you identify any errors or fraudulent activities that may negatively impact your score. Make sure you check your credit report at least once a year and report any discrepancies to CIBIL immediately.

Monitor your credit report regularly - Avoid hard inquiries: Hard inquiries occur when a financial institution checks your credit report to assess your creditworthiness. Multiple hard inquiries can negatively impact your score, so avoid applying for credit facilities unless you need them.

- Build a good credit history: Finally, building a good credit history takes time and patience. Focus on paying your bills on time, reducing your credit utilization, and maintaining a good credit mix. Over time, your score will improve, and you will be able to access credit facilities at lower interest rates.

There are no shortcuts to improving your credit score immediately. It requires consistent adherence to responsible credit habits over time. By paying bills on time, reducing credit card utilization, maintaining a mix of credit, limiting credit applications, and monitoring your credit report, you can gradually increase your CIBIL score and improve your creditworthiness.

Conclusion

In conclusion, a good credit score is essential for accessing credit facilities at lower interest rates. If you have a low CIBIL score, there are several steps you can take to improve it. Check your credit report for errors, pay your bills on time, reduce your credit utilization, maintain a good credit mix, close unused credit accounts, negotiate settlements, monitor your credit report regularly, avoid hard inquiries, and build a good credit history.

By following these steps, you can increase your CIBIL score from 600 to 750 and access credit facilities at lower interest rates. Remember, building a good credit history takes time and patience, so focus on the long term and stay disciplined in your credit habits.

Frequently Asked Questions-

How can I increase my CIBIL score from 600 to 750 immediately?

Improving your credit score takes time and consistent effort. However, you can work towards increasing your score by making timely payments, reducing credit card balances, managing debts responsibly, and maintaining a positive credit history over time.

How can I increase my CIBIL score to 750?

To increase your CIBIL score to 750, focus on paying bills on time, reducing credit card utilization, maintaining a mix of credit, avoiding multiple credit applications, monitoring your credit report for errors, and maintaining a good credit history.