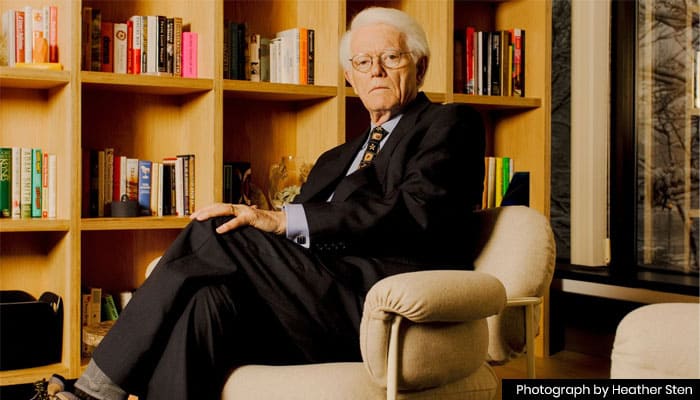

One of the greatest investors of all time, Peter Lynch is well known for leading the Fidelity Magellan Fund from 1977 to 1990, during which time he produced an incredible annualized return of 29%. Numerous investors worldwide have been influenced by his investment strategy, which is based on simplicity, in-depth study, and a profound understanding of the firms he invested in.

We’ll look at the top 10 learnings from Peter Lynch in this blog, which can help you make more informed investing decisions. These ageless lessons can give you the confidence to confidently navigate the intricacies of the stock market, regardless of your level of experience.

Also, read Should you Buy Term Insurance with Return of Premium in 2023?

10 learnings from Peter Lynch

-

Know what you own, and know why you own it

Peter Lynch’s philosophy was that investors should do their own research and understand the businesses they are investing in. For example, if you are considering investing in a tech company, it’s important to understand the company’s products and how they fit into the larger tech landscape.

-

Buy what you know

Lynch believed that investors should stick to companies and industries that they are familiar with. For example, if you work in the retail industry, you may have an edge in evaluating retail stocks.

-

Be patient

Lynch emphasized the importance of holding onto investments for the long-term, rather than trying to time the market. For example, instead of trying to predict when a stock will reach its peak and selling, it’s better to hold on to a stock that has strong fundamentals and a solid management team.

Top 10 learnings from Peter Lynch -

Don’t try to time the market

Lynch believed that it’s impossible to predict when the market will go up or down, so trying to do so is a waste of time. For example, instead of trying to time the market by buying low and selling high, it’s better to focus on finding great companies and holding on to them for the long-term.

-

Look for companies with strong earnings growth

Lynch believed that companies with strong earnings growth are the ones that will perform well in the long run. For example, a company that has consistently grown its earnings year over year is more likely to be a good investment than one that has flat or declining earnings.

-

Avoid trendy stocks

Lynch warned against investing in companies that are popular in the media but may not have strong fundamentals. For example, instead of investing in a company that’s getting a lot of buzz on social media, it’s better to focus on companies that have a solid track record of earnings growth.

Top 10 learnings from Peter Lynch -

Be contrarian

Lynch believed that investors should look for opportunities where others see value, but may be overlooking. For example, instead of following the crowd and buying stocks that everyone is talking about, it’s better to look for companies that are undervalued and have the potential to grow.

-

Avoid over-diversification

Lynch believed that investors should focus on a small number of high-quality companies, rather than spreading their money across a wide range of stocks. For example, instead of owning shares in 20 different companies, it’s better to focus on a few companies that have strong fundamentals and a good management team.

-

Be willing to take losses

Lynch emphasized the importance of cutting losses quickly when an investment is not working out. For example, instead of holding on to a stock that is losing value, it’s better to sell it and move on to more promising investments.

-

Don’t be afraid to buy when others are selling

Lynch believed that investors should take advantage of market downturns to buy stocks at discounted prices. For example, instead of panicking and selling stocks during a market crash, looking for opportunities to buy great companies at a discount is better.

Conclusion

The financial ideas that Peter Lynch advocated are just as relevant now as they were back in the day of his distinguished professional life. You may create a solid investment plan that endures over time by putting a strong emphasis on research, keeping an eye on the big picture, and avoiding the traps of following the herd. Lynch strongly focuses on making well-informed decisions by helping you understand what you invest in and how to maintain patience in market volatility.

As you apply these learnings from Peter Lynch’s career to your investment journey, remember that long-term stock market success comes from deliberate, disciplined investing rather than from fast gains.